Citizens Bank, the 16th-largest bank in the US, is warning 8,358 customers of a serious data breach caused by insider misconduct.

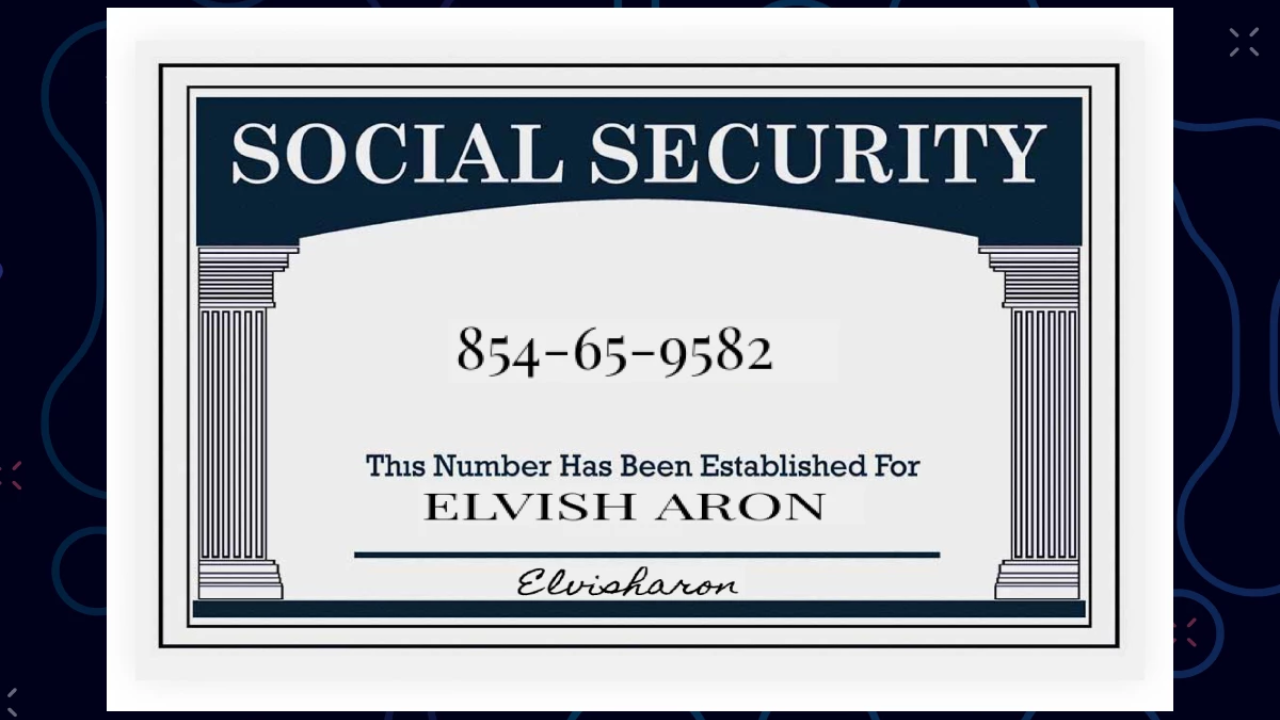

The breach occurred on October 23, 2023, and compromised highly sensitive personal information, including account numbers, Social Security numbers, dates of birth, and identification details.

Details of the Breach

The bank disclosed the breach in a filing with the Office of the Maine Attorney General. It is believed that the incident stemmed from insider wrongdoing, raising concerns about internal security measures.

To help mitigate potential risks, Citizens Bank is offering affected customers a free two-year membership to an identity theft credit monitoring service.

A Recurring Security Problem

This is not the first time Citizens Bank has faced security challenges. Just two months prior, the bank experienced another breach where unauthorized parties accessed personal information from around 100 customers. These incidents highlight ongoing vulnerabilities in the banking sector.

The Bank’s Size and Reach

With $220 billion in total assets, Citizens Bank is a major player in the US banking industry. It operates nationwide and serves millions of customers.

A breach of this scale raises questions about how well large financial institutions protect customer data.

What Customers Should Do?

Customers affected by the breach should take immediate steps to protect their personal and financial information. This includes:

- Monitoring Accounts: Keep a close eye on bank statements for unusual activity.

- Using Identity Theft Services: Take advantage of the free credit monitoring offered by the bank.

- Updating Security Measures: Change passwords and enable two-factor authentication where possible.

- Reporting Suspicious Activity: Notify the bank and law enforcement if any fraudulent activity is detected.

The Bigger Picture

Insider threats are a growing concern in the financial sector. Unlike external cyberattacks, insider breaches can be harder to detect and prevent, as they often involve trusted employees misusing access privileges.

The financial industry, particularly large institutions like Citizens Bank, faces increasing pressure to strengthen internal controls and cybersecurity measures to protect customer information.

How the Bank Is Responding?

Citizens Bank is taking steps to investigate the breach and has reassured customers that it is committed to preventing such incidents in the future. However, trust among affected customers may take time to rebuild.

Lessons for the Banking Industry

This breach serves as a wake-up call for all banks to reassess their security frameworks, particularly around insider threats. Customers also need to remain vigilant, as even the most secure systems can have vulnerabilities.

Conclusion

As one of the largest banks in the US, Citizens Bank’s data breach is a significant reminder of the importance of cybersecurity.

Affected customers should take proactive steps to safeguard their information, while the bank must work on rebuilding trust and reinforcing its security systems.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!

Leave a Reply