The Social Security Number (SSN) is an important part of life in the United States. It’s used to track earnings, determine eligibility for benefits, and serve as an ID for various purposes. Because of its significance, it’s essential to keep your Social Security Card in a safe place and avoid sharing it unnecessarily. However, sometimes...

Author: Milton Dalton (Milton Dalton)

Big News for Seniors: A $500 Social Security Boost in 2025 You Can’t Miss!

The Cost of Living Adjustment (COLA) is an annual adjustment made to Social Security payments in the United States to help seniors keep up with inflation. This adjustment is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) during the third quarter of the year. Since inflation rates change...

Social Security Offices to Close for 24 Hours in December, Payment Adjustments Announced!

Christmas is almost here, and while it’s a season for joy and relaxation, some responsibilities, like Social Security payments, don’t take a break. The Social Security Administration (SSA) has made adjustments this December to ensure payments are processed smoothly, even as their offices close for key holidays. The SSA has confirmed that all payments will...

Will You Take Social Security in 2025? Here’s Why Your Full Retirement Age Matters?

Social Security is a vital part of retirement planning. Many people think retirement starts at 65, but that’s not always the case. You can start claiming Social Security benefits as early as 62, though the checks will be smaller. To get the maximum benefit, you need to wait until your “full retirement age.” For those...

Retirement Planning: How Far $250,000 in Savings and Social Security Will Take You Nationwide?

Planning for retirement involves understanding how your savings and Social Security benefits will sustain you. The longevity of $250,000 in savings, when combined with Social Security income, varies significantly across the United States due to differences in cost of living, taxation, and healthcare expenses. This article examines how far $250,000 in savings plus Social Security...

Say Goodbye to Old SSI Rules: What You Need to Know About Changes in 2025 Payments?

Millions of people who receive Supplemental Security Income (SSI) benefits are preparing for major changes to the payment schedule in 2025. These changes are part of efforts to improve the financial support for those who depend on SSI, and understanding these changes is important for all recipients. One of the most anticipated changes is a...

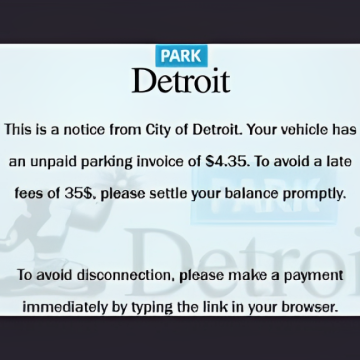

Detroit Officials Alert Drivers About Fake Parking Fee Texts and How to Avoid Them?

DETROIT – Have you received a text saying you have an unpaid parking fee in Detroit? If so, don’t panic. The city of Detroit has warned that such messages are part of an ongoing scam targeting drivers. The city’s warning, issued on Thursday, tells residents that text messages about unpaid parking fees are not legitimate....

Car Crashes Into Backyard: Homeowners Left in Shock and Fear for Safety!

In a shocking incident early this morning, a car crashed into a backyard, leaving homeowners in fear for their safety. The crash took place in a quiet residential neighborhood, where many families live in peaceful surroundings. According to local authorities, the car veered off the road, crashing through the backyard fence and landing just a...

Breaking: Joy Road Road Rage Shooting Suspect Surrenders to Authorities After Violent Incident!

A suspect involved in a road rage shooting on Joy Road has turned himself into the police. This incident shocked the local community, leaving many wondering what led to the violent act. The shooting occurred after a tense argument between two drivers escalated into a dangerous situation on the road. Witnesses reported that the suspect...

IRS Confirms $2,000 Child Tax Credit for 2025: Eligibility and Income Rules!

The Child Tax Credit (CTC) is a key financial benefit in the U.S. tax system, aimed at helping families with children under 17. For the tax year 2025, the Internal Revenue Service (IRS) has set the maximum credit at $2,000 per qualifying child, with a refundable portion capped at $1,700. This credit can directly lower...