Weeks after a federal judge allowed Hunter Biden’s tax return information leak lawsuit against the IRS to move forward and denied an attempt by special agents turned whistleblowers to intervene, the agents have launched an appeal.

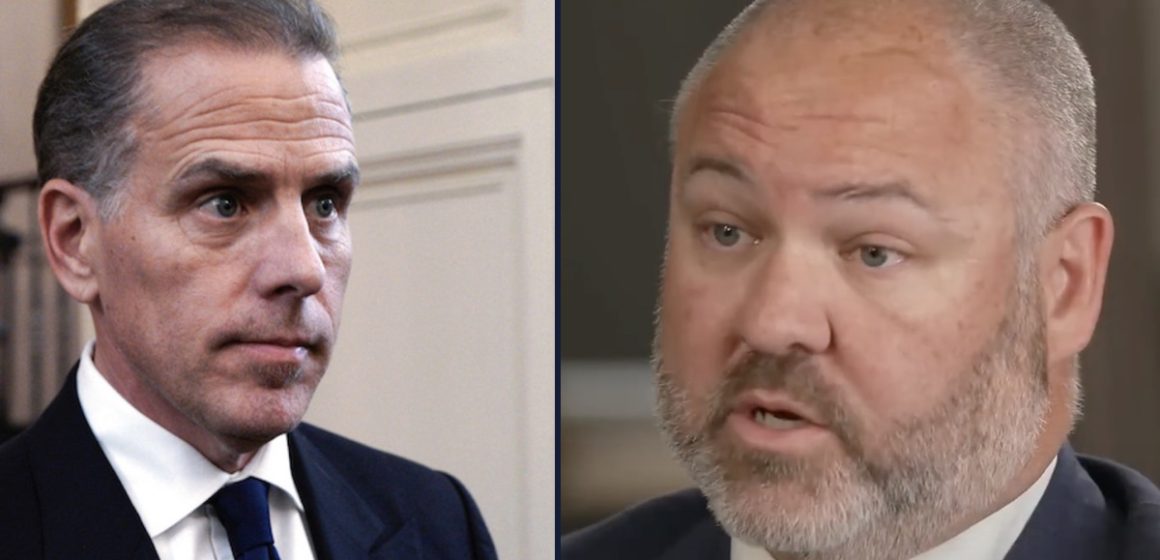

On Friday, IRS supervisory special agent Gary Shapley and IRS special agent Joseph Ziegler filed a notice of appeal to the U.S. Court of Appeals for the D.C. Circuit, in a bid to overturn Barack Obama-appointed U.S. District Judge Rudolph Contreras’ ruling that the two “do not have a legally protected interest in the outcome of this litigation” and are not, as they maintained, “the real subject” of Biden’s case.

Well before Hunter Biden was convicted of federal gun felonies and later opted not to take his tax crimes case to trial, Shapley and Ziegler publicly testified before Congress in the summer of 2023, alleging that “unethical slow-walking and preferential treatment” and “deviations from the normal investigative process” made it impossible to bring felony tax evasion and “fraud or false statements” charges connected to Biden’s business dealings with the Ukrainian gas company Burisma while his father, President Joe Biden, was the vice president of the United States.

Shapley, a 14-year IRS employee, for instance sat for an interview with CBS in May 2023 where he alleged “irregularities” on the part of the DOJ in the handling of the Biden probe, “deviations” from regular practice that he said each time benefited the subject of the probe (in that interview, Shapley did not name the subject, citing tax secrecy laws).

Biden responded in September 2023 by filing a lawsuit against the IRS, not naming Shapley and Ziegler as defendants but nonetheless claiming that the agency should be liable for the “unauthorized” disclosure of his tax return information through the agents’ attorneys.

The suit slammed the “more than 20 nationally televised and non-congressionally sanctioned interviews and numerous public statements by Mr. Shapley, Mr. Ziegler, and their counsel” — Attorney A — “in these public appearances” on Fox News, The Megyn Kelly Show, John Solomon Reports, CNN, and CBS.

More Law&Crime coverage: Hunter Biden’s litigation spree continues with lawsuit against IRS over whistleblower media ‘campaign to publicly smear’ him and ‘assault’ privacy rights

“This lawsuit is not about the legitimacy of the IRS investigation of Mr. Biden over the past five years or any decision to penalize Mr. Biden for any failure to comply with his obligations under the tax laws. This lawsuit is not about the proper workings of the whistleblower statute and process, nor an official using those procedures properly to make disclosures to authorized government officials,” Biden’s suit claimed. “Rather, the lawsuit is about the decision by IRS employees, their representatives, and others to disregard their obligations and repeatedly and intentionally publicly disclose and disseminate Mr. Biden’s protected tax return information outside the exceptions for making disclosures in the law.”

Biden’s suit further argued, citing Shapley and Ziegler’s experience as agents and citing congressional “admonitions,” that the agents “knew that making any person aware of any individual’s tax information in any manner” — let alone in a “campaign to publicly smear” him — “constitutes a violation of federal tax law.” Biden also questioned the legitimacy of their whistleblower status.

“Yet, these IRS agents and their attorneys willfully disregarded federal tax law, undermining Americans’ faith in the IRS and the purported confidentiality of its investigations,” court documents said. “These agents’ putative ‘whistleblower’ status cannot and does not shield them from their wrongful conduct in making unauthorized public disclosures that are not permitted by the whistleblower process,” the filing said. “In fact, a ‘whistleblower’ is supposed to uncover government misconduct, not the details of that employee’s opinion about the alleged wrongdoing of a private person.”

As recently as late September, Judge Contreras tossed a Privacy Act violation claim while ruling in favor of Biden’s unlawful disclosure claim against the IRS, writing that “the lawyers’ actions can be imputed to the IRS employees — and therefore the United States — under general principles of agency law” since the “lawyers acted as the agents of the two IRS employees.”

More Law&Crime coverage: IRS fails to get rid of Hunter Biden lawsuit over leaked tax returns

At the same time, he declined to allow Shapley and Ziegler to intervene, concluding that the “real subject of this controversy is the United States’s liability” and that the “resolution of that dispute will have no direct impact on the intervenors’ legally protected financial or property interests.”

In the judge’s view, their “concerns” about non-intervention impacting other civil cases through “collateral estoppel” — whether in “future” whistleblower retaliation claims or in a defamation suit filed last month against Biden attorney Abbe Lowell — weren’t legally persuasive [some citations removed for ease of reading]:

Evidently, Shapley and Ziegler do not agree with that analysis, as they have a noticed an appeal in response.

“With respect to the Order, Proposed Intervenors respectfully provide notice of their intent to evaluate and pursue all meritorious claims on this appeal of the Order which ‘prevents a putative intervenor from becoming a party in any respect . . . [and, therefore] is subject to immediate review,’” the “timely” notice said.

Marisa Sarnoff contributed to this report.

Have a tip we should know? [email protected]

Note: Thank you for visiting our website! We strive to keep you informed with the latest updates based on expected timelines, although please note that we are not affiliated with any official bodies. Our team is committed to ensuring accuracy and transparency in our reporting, verifying all information before publication. We aim to bring you reliable news, and if you have any questions or concerns about our content, feel free to reach out to us via email. We appreciate your trust and support!

Leave a Reply