Jeff McMorris, senior director of Spokane County’s Finance and Administration Division, issued a “reality check” on Monday, warning of a $20 million deficit by 2026.

McMorris, the husband of former U.S. Rep. Cathy McMorris Rodgers, R-Washington, informed the Board of County Commissioners that this is a long-term issue. He succeeded Randy Bischoff, who had held the jobs until recently and helped balance a similar shortage last summer into the fall.

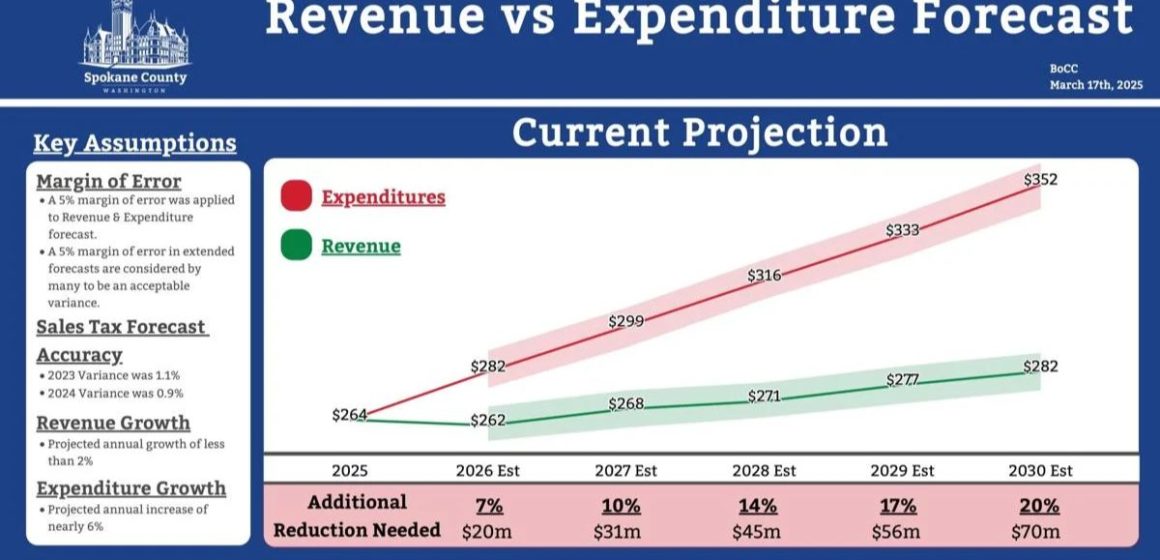

According to recent forecasts, general fund income would drop to $262 million next year, $2 million less than the anticipated amount for 2025. Meanwhile, McMorris estimates spending to climb $282 million next year and more than $350 million by 2030, but revenues will only reach $281.9 million by then.

He cited an underlying situation in which federal COVID-19 disaster money is running out and municipalities around the country face budget deficits. Meanwhile, Gov. Bob Ferguson is addressing a state deficit while Elon Musk and the Department of Government Efficiency reduce federal spending.

“We’re heading into a big contrast,” McMorris said. “The extra money outlook is going in the opposite direction, and that’s going to impact this year’s budget. Things are not super great.”

Tessa Sheldon, budget and finance operations manager, stated that the problem is countywide, not only in the general fund. Much of the entire budget is dependent on federal and state funds, so she believes the county must make those working with each fund “fully aware of our economic situation.”

Read More – Denver Faces Potential Loss of $32M in Federal Funds Over Migrant Aid

Spokane County’s sales tax income increased by an average of 4% per year between 2000 and 2023.

The majority of the county’s general fund earnings come from sales tax (30%), followed by service charges (26%), and property taxes (24%). Sheldon stated that these predictions do not include the 1% property tax increase authorized by state law, but even so, the county is limited on revenue alternatives.

According to McMorris, salaries and benefits account for 69% of the general fund budget, followed by goods and services at 28%. Labor contracts and other agreements require the county to provide raises and cost-of-living adjustments, limiting the county’s ability to minimize costs.

“Our forecast is showing a $20 million deficit in 2026,” Sheldon said.

McMorris stated that county agencies are beginning to identify efficiencies. He advised that the board impose a hiring freeze and explore eliminating services that state law does not require the county to offer. Another alternative was to eliminate 106 vacant posts, which would save $10 million.

Bischoff urged the county to reduce a comparable number of posts last year, but eventually retracted the proposal to allow departments to make their own cuts. McMorris stated that in the future, he would conduct a monthly review of the board to keep track of the situation.

“We’re not in the hole,” he said. “We have a fund balance. It’s just if we don’t start doing something now, give it a year, and we’ll be in a tough situation.”

Leave a Reply