A significant economic topic in recent years has been the long-term effects of inflation. Although wages in the U.S. have increased compared to before the pandemic, the rising prices in various consumer categories have limited the overall benefit for most households. The U.S. Bureau of Labor Statistics is currently stating that prices are increasing by more than 3%, which is notably higher than the target inflation rate of 2%. The recent rise in the CPI was mainly due to higher prices for eating out, transportation, and housing.

Household incomes are often significantly affected by the second category. Housing is the biggest expense for most households. When wages don’t increase at the same rate as housing prices, it makes housing even more expensive in terms of actual money. Since the pandemic started, housing prices have gone up a lot. The cost of homes sold in the U.S. has increased by over 40%.

Home Prices and Household Incomes Changes

However, it is not a recent development that income growth is not keeping up with rising housing costs. For at least the last two decades, the rate at which median income has increased has been slower than the rate at which home prices have increased. According to data from the U.S. Census Bureau and Zillow, between 2000 and 2022, the median annual household income in the U.S. went up by 77.6%, from $41,990 to $74,580. During the same period, the median home price almost tripled, increasing by 170% from $123,086 to $332,826. Since 2000, when accounting for inflation, household incomes only increased by 4.5%, while home prices increased by 59.1%.

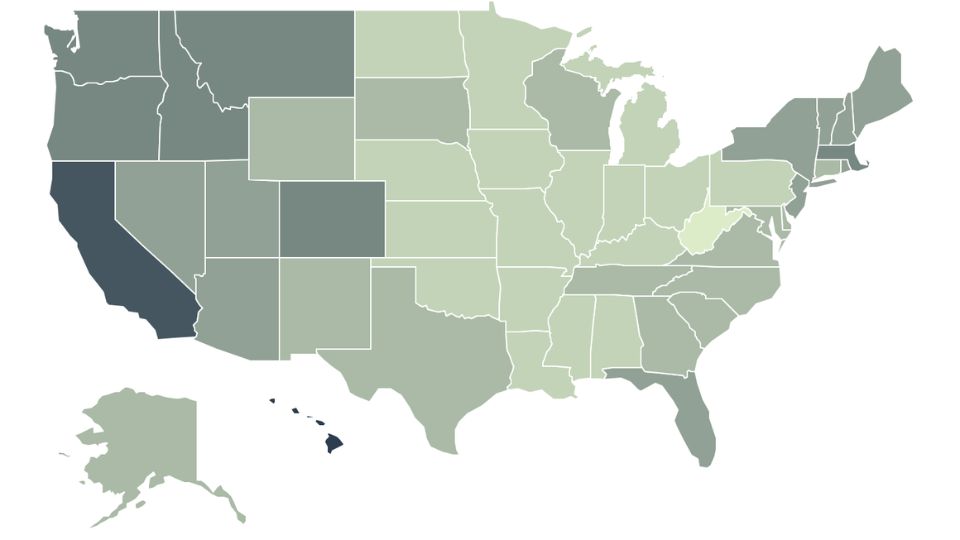

Geographical Differences in Home Price

The difference between how much wages are increasing and how much home prices are increasing may have the biggest impact in areas where home prices are rising the quickest. States in the Mountain West have experienced the fastest growth in housing costs in recent years. Montana has seen the highest increase, with the median home price rising by 71.2% in the last five years. States in the western region such as Idaho, Arizona, Utah, and New Mexico have also experienced significant increases in home prices during that time.

Also Read: In New Jersey, We Must Need to End Homelessness Stigma

Price-to-Income Ratio by State

Several states in the Mountain West region, which experienced a significant increase in home prices in recent years, are now leading the nation in terms of the ratio of home prices to income. The ratio of the median home price to the median income is a way to measure how affordable housing is. The national ratio is 4.7, but the top 10 states, with nine of them located in the West, currently have ratios of 5.7 or higher. The states with the highest home prices and ongoing problems with affordable housing are Hawaii (9.1) and California (8.4). And at the local level, some cities in California are even more expensive, with four out of the top five most expensive large cities in the U.S. being located in the Golden State.

This analysis was done by Construction Coverage, a website that compares construction software and insurance. They used data from Zillow and the U.S. Census Bureau. Researchers sorted locations based on the ratio of the median home price to the median annual household income.

Here is a brief overview of the information about Arkansas:

- Home price-to-income ratio: 3.6

- Median home price: $198,838

- Median household income: $55,432

- 5-year change in median home price: +41.4%

- Mortgage holders spending >30% of income on housing: 22.5%

Here are the statistics for the entire United States:

- Home price-to-income ratio: 4.7

- Median home price: $347,716

- Median household income: 74,755

- 5-year change in median home price: +49.2%

- Mortgage holders spending >30% of income on housing: 27.8%

Leave a Reply