Purchasing a house for only one dollar – it seems too good to be true. Yes, that’s correct. “According to Dr. Dwanda Farmer, a community economic development expert and CEO of the CED Doctor in Baltimore, you will likely need around $150-200,000 to renovate one of these structures.”

The Department of Housing and Community Development (DHCD) is now asking applicants for its new “Fixed Pricing Program” to show that they have at least $90,000 available to renovate a home after buying it for only one dollar.

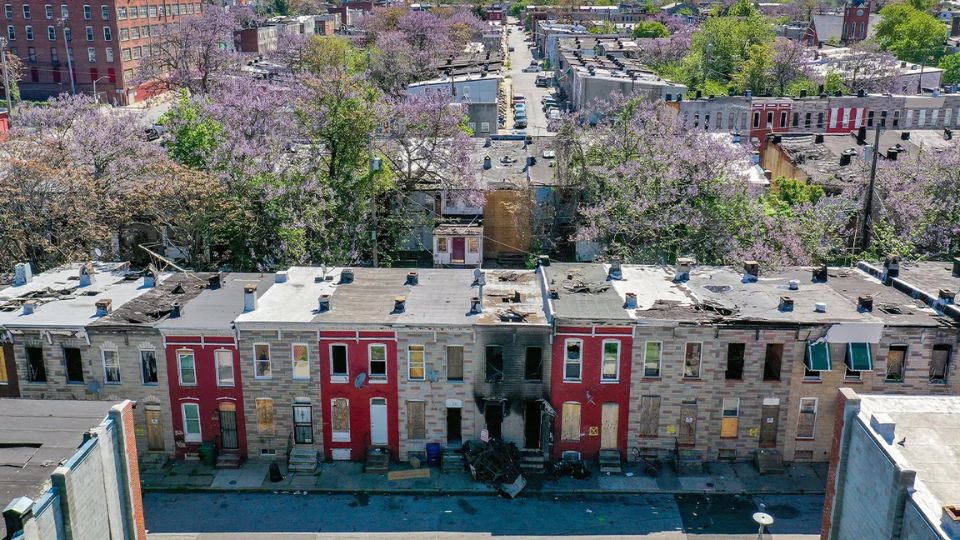

The aim is to renovate some of the many empty houses in the city. The link to the application is now available. The department will start reviewing applications on April 1st.

Developers can buy it for $3,000, and nonprofits can buy it for $1,000. Individual buyers can buy for $1, but they have to live in the home for five years.

Dr. Dwanda Farmer and Nneka Nnamdi, Executive Director of the SOS Fund, who support affordable housing, believe that the program does not prioritize the people who are in greatest need of assistance.

“Over the past thirty years, Baltimore City has offered incentives to developers who cater to the needs of the community with incomes at or above 80% of the Area Median Income (AMI).” I am asking the mayor to limit future public investment to areas where it is most needed, specifically those with 50% and 30% of the Area Median Income (AMI). Currently, Baltimore City has 38 units available for every 100 units needed for households with incomes at or below 30%, and 58 units available for every 100 units needed for households with incomes at or below 50%. “But we are already at 80% capacity,” Dr. Farmer said.

Also Read: This Midwest City Becomes the Best Place to Live in U.S. for 2024

They are worried that gentrification will force long-time residents to leave. They referred to the ‘dollar home’ program from the 1970s as an example of what not to do. The city provided buyers with loans funded by the federal government to assist with renovations. However, this time the city does not have the funding available to offer these loans. Many of the row homes on Fort Avenue in Federal Hill were sold for only one dollar in the past. The properties that were once in poor condition have now been renovated and are now occupied by residents with higher incomes, both homeowners and renters.

“We don’t want to see that kind of story spreading into Harlem Park, Poppleton, or the Middle East.” Nnamdi said that we want the people who have been the main support of the city, who have paid a lot of property taxes, and who have dealt with bad city services to be able to live freely and comfortably in a city that they helped build with their work and ideas.

“I understand that their goal is to encourage middle-income families to move into the city.” According to Dr. Farmer, middle-income families are not interested in buying a run-down house, even if it’s only for a dollar. They would only consider it if there is a concrete plan for renovating the entire block.

Applicants will also go through a vetting process. The city will review their criminal history and check if they have any outstanding liens or judgments. The program’s website states that the department will also evaluate whether applicants own vacant buildings that are older than two years or less than two years without a recent open/active permit. This is done to determine their experience and preparedness for rehabilitation projects.

The advocates we talked to hope that this is sufficient to identify and remove potential individuals who may engage in harmful behavior.

“I’m worried that this will give an opportunity for the same bad landlords and investors who have been neglecting properties and charging high rents in the city for a long time,” Nnamdi expressed.

To further prevent this, the first 90 days of the program are reserved exclusively for buyers who intend to use the home as their main residence. The DHCD has already received over 800 inquiries from these buyers. Currently, there are fewer than 300 homes available for the program. The department informed WMAR-2 News that the property listing will be regularly updated and subject to change.

Leave a Reply