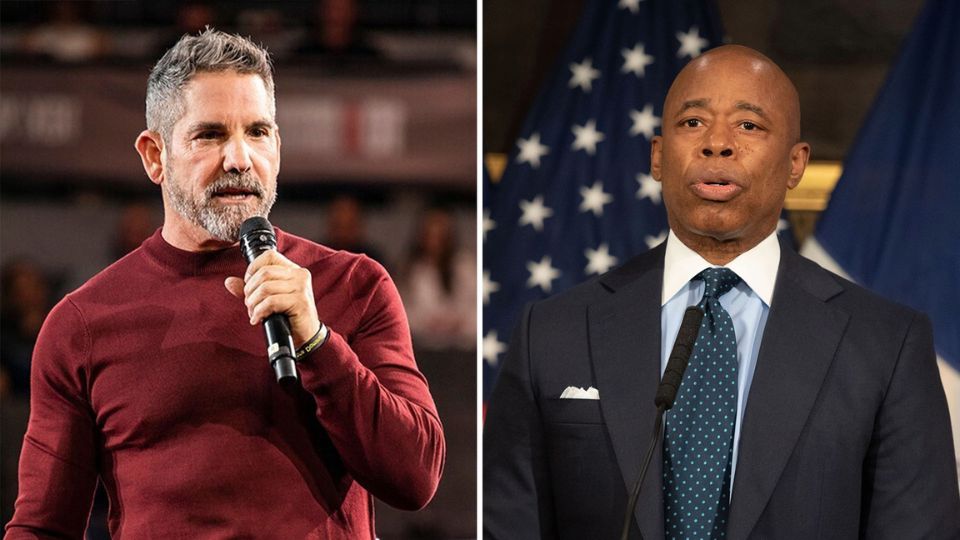

After the verdict in former President Trump’s fraud trial, some real estate investors across the country, such as Grant Cardone from Cardone Capital, are instructing their teams to leave New York and move elsewhere.

“We believed that this year was the perfect chance to visit Chicago, California, and New York City.” I have been waiting for 40 years to invest in that marketplace. Cardone told Steve Doocy on “FOX & Friends” on Wednesday that he was very confident that this year was the right time to come. “And when that decision was made, it was like, stop working.” Do not touch it. Avoid going to that place.

The business leader became well-known recently when he announced on X that his company would stop providing financial support for real estate projects in New York City. Instead, they will concentrate on other markets such as Texas and Florida.

Cardone also mentioned that New York has risks that are greater than the opportunities when it comes to property value. He believes that the state’s political bias affects its ability to conduct business.

“At Cardone Capital, we invest on behalf of 14,000 investors who rely on cash flow.” “If I am unable to forecast the cash flow due to certain regulations or the presence of migrants, or if I am unable to remove tenants, New York City continues to prioritize selling real estate in Florida rather than in New York,” explained the fund manager.

There are more financial worries in New York for pension funds, lenders, and public real estate investment trusts because of the legal consequences of the $355 million Trump ruling. Cardone mentioned that this could lead to a decrease in property value and more people being unable to repay their loans, which could then affect regional banks.

Also Read: Illinois Has an Own Area 51 and That’s Really Interesting!

“The amount of money you can borrow is determined by how much the property is worth.” I will need to provide detailed information about the cash flow, income, and estimated value of my property in order to meet their requirements for underwriting. The investor mentioned that the broker provided a valuation for it. Additionally, the bank plans to obtain at least one or possibly two more appraisals, which will be independent of the investor.

“There might be up to five appraisals for that.” When I buy something, I don’t plan on selling it right away. So, when I determine the value of a property, I consider this long-term perspective. “When it comes to Trump, he is not selling any of this stuff,” Cardone continued. “We are interested in acquiring the property because it generates a steady income.” Every seller will always try to increase the price based on future expectations, not through fraudulent means.

Kevin O’Leary, the chief of O’Leary Ventures and known as “Mr. Wonderful” on “Shark Tank,” expressed similar concerns as Cardone on the show “Cavuto: Coast to Coast.” He cautioned against investing in New York after the trial involving Trump.

“New York was already considered a state that was not doing well, similar to how California is also considered a state that is not doing well.” “There are many states that are considered losers due to their policies, high taxes, and excessive regulation,” he said. “I don’t want to invest in New York at this time. “And I’m not the only one saying that.”

Leave a Reply